Russia’s push to strengthen its maritime and transport sectors faces major hurdles. Despite ambitious projects like the Northern Sea Route and the International North-South Transport Corridor, logistical and financial constraints undermine progress. Russian efforts aim to bypass sanctions but may yield long-term benefits beyond the current regime.

Personnel changes

Personnel changes following Putin’s inauguration and alterations in the structure of the Presidential Administration point to a significant strengthening of the group responsible for infrastructure and transport in the government, and the creation of a powerful maritime geostrategic cluster in the Presidential Administration.

Nikolai Patrushev moved from his post of Secretary of the Security Council into a position specially created for him, of presidential aide responsible for shipbuilding. At the same time, he retained his role as a permanent and leading member of the Security Council. Most of Patrushev’s team also remained on the Council. The newly appointed secretary, former defence minister, Sergei Shoigu, was unable to appoint his own people and looks like a fish out of water in this post, as does the deputy secretary, Dmitry Medvedev. The creation of a Maritime Collegium under Patrushev effectively makes him ‘First Lord of the Admiralty’, a key figure in the Kremlin’s project to strengthen Russia’s position as a great maritime power.

Patrushev’s deputy when he was Security Council Secretary, Sergei Vakhrukov, was appointed head of the new presidential directorate for national maritime policy. And Viktor Yevtukhov, Deputy Industry Minister with responsibility for shipbuilding, was made head of another new directorate, for state policy in the defence-industrial complex.

When we add in the promotion to Vice-Premier of Vitaly Savelyev, the Minister of Transport and the appointment of Igor Levitin, a former Minister of Transport, as an adviser in the international directorate for cooperation on transport, we can see that a powerful cluster of personnel has been created on transport and geostrategy in both the Presidential Administration and the government.

As for Patrushev, as well as retaining his influence in the Security Council, Putin has placed him in what the Kremlin regards as a key area. He is now responsible for the practical realisation of the Maritime Doctrine which he has been working on since the start of the war in Ukraine.

It is notable that according to the Maritime Doctrine, Russia ‘will employ its military might when necessary’ to defend Russia’s national interests on the high seas in crucially important regions. These include:

- The Arctic Basin adjoining the coast of Russia, including the area of the Northern Sea Route;

- The continental shelf beyond the 200-mile economic exclusion zone of the Russian Federation, as well as in important areas of the global oceans, including the Eastern part of the Mediterranean Sea;

- The Black Sea, Baltic Sea and Kurile Straits;

- Areas of global maritime communications, including those along the Asian and African coastlines.

Putin’s major monopoly companies are tasked with working directly on transport and geostrategic tasks.

Putin’s monopoly companies

Putin’s regime today combines the nomenklatura which has replaced the old elites (but nevertheless lacks the capacity to act), and the monopolies. These are multifaceted conglomerates which fulfil a wide variety of functions and add flexibility, adaptability and a certain effectiveness to the regime when solving various issues.

Among them are:

- Gazprom, led by Aleksei Miller;

- Rosneft, under Igor Sechin (also under his control is Putin’s ‘wallet’, the Rosneftegaz holding, which contains the Gazprom and Rosneft shares)

- Rostec, under Sergei Chemezov;

- Sberbank, under the chairmanship of German Gref (an almost inexhaustible source of cheap money);

- VTB Bank, led by Andrei Kostin, which manages the United Shipbuilding Corporation (USC) on behalf of the state (USC carries out 80% of all shipbuilding in the Russian Federation);

- Rosatom, headed by Aleksei Likhachev, under the supervision of Sergey Kiriyenko, and which lies within the sphere of influence of Putin’s close associates and friends, the Kovalchuk brothers:

- Mikhail Kovalchuk, president of the Kurchatov Nuclear Institute (ostensibly a multi-faceted institute, but in reality his own);

- Yury Kovalchuk, the owner of Rossiya Bank and an officially ‘not state-owned’, but all-encompassing and ultra-loyal media empire.

Others who are involved in the transport and geostrategic issues are Nikolai Tokarev (Transneft); Vitaly Savelyev (Vice-Premier of the government, responsible for infrastructure); Yury Trutnev (both the plenipotentiary representative of the President and Vice-Premier for the Far East and the Arctic); Igor Levitin (adviser and special representative in the international directorate for cooperation on transport); as well as other officials and minor government staff.

Another official who should not be forgotten is Sergei Ivanov, formerly Putin’s chief strategist, and now a full member of the Security Council and special presidential representative for ecology and transport.

As both one-off and constant actions, the monopolies carry out various non-core routine and political functions, such as:

- Russia’s geopolitical and geostrategic Eurasian objectives – achieved with the use of Gazprom as an alternative to the Foreign Ministry;

- Control of the media through the joint action of Roskomnadzor [the official censor] and Yury Kovalchuk’s media empire;

- Ideological indoctrination of citizens through a network of theme parks called ‘Russia is my history’, where the main sponsors are Norilsk Nickel, owned by the Arctic oligarch, Vladimir Potanin, and Sberbank;

- The appropriation of the Arctic through Rosatom’s activation of the Northern Sea Route accompanied by the theatrical elimination of pollution and the development of the re-nationalised Vladivostok seaport;

- Geopolitical influence in the Americas, thanks to Rosneft’s projects in Venezuela and Cuba;

- Rosneft’s financial participation in projects which might be considered unusual for an oil company, such as genetic research (Putin’s daughter is involved).

The way in which these monopolies have been removed from government control and made accountable directly to the president shows that they are a model of what state capitalism means to Putin. In this model, huge state resources can be used exactly as Putin wants without any oversight – to satisfy his own private demands or those of the people closest to him, or perform secret operations anywhere in the world.

The role of the monopolies has increased significantly during the war:

- Rostec forms the basis of the Russian military-industrial complex, and it now has access to the nationalised enterprises which are fulfilling orders for the military. Denis Manturov, Rostec’s appointee, has been elevated to the post of first vice-premier of the government; in other words, he is an alternative prime minister;

- As well as organising underhand schemes to export Russian oil and avoid sanctions, Rosneft is carrying out an expansion of the Russian energy market. Its managers have been put in charge of two requisitioned European energy companies, Uniper and Fortum. Furthermore, on more than one occasion Rosneft has implicitly demonstrated its intention to take over Lukoil, Russia’s second-largest oil producer;

- Rosatom and Rosneft are involved in shipbuilding for the Arctic, and regularly open up year-round navigation in the eastern sector of the Northern Sea Route;

- Through its powerful scientific production base, Rosatom is engaged in import substitution for the automobile and aviation sections; digital technology and artificial intelligence; green energy; robot technology; ecology; and medicine.

These chaebols represent a state within the Russian state. Even if Putin’s regime were to collapse at the top, the next level which would remain would be the state ‘branches’ he has created: the monopolies.

Putin has always devoted a great deal of attention to the Far East and the Arctic, and he continues to do so. He made the decisive step in bringing the management of these two regions together in February 2019, when he re-tasked the Ministry for the Development of the Far East as the Ministry for the Development of the Far East and the Arctic. As a result, Yury Trutnev, who was responsible for the Far East both as a member of the government and as the presidential representative, was given unique authority. He became responsible for an area which covered more than half the country.

Nearly all the regions of this enormous territory – ‘the Russian frontier lands’ – have access to the sea. Shipping and shipbuilding not only serve Russia’s ambitions to be a great maritime power, but they are what brings together a significant part of the country. This is an important symbol, and this is why Putin personally takes part (offline or online) in the laying down or the launch ceremonies of all significant ships, be they warships or cargo.

On each of the five occasions he has been in Vladivostok, Putin has visited the Far Eastern shipyard ‘Zvezda’, which is considered his ‘baby’: in 2016, 2017, 2018, 2019 and 2023. He has been to the ‘Admiralty Wharf’ shipyard in St Petersburg also five times, in 2002, 2008, 2009, 2019 and 2021. In 2023 alone, he visited shipyards on three occasions. In September he took part in the ceremony at ‘Zvezda’ of the naming of two Arctic ice-strengthened tankers, returning in December for the flag-raising ceremony. And before this he went to the ‘Sevmash’ shipyard in Severodvinsk, near Arkhangelsk, to take part in the flag-raising ceremony for a nuclear submarine and a cruiser submarine, and then went on to ‘Admiralty Wharf’ in St Petersburg to see a new type of frigate carrying the hypersonic ‘Zircon’ missiles.

On the night of 26 June, just a few weeks after his inauguration, Putin held a meeting on the development of shipbuilding and its role in the defence and security of the state.

Just as with the previous similar meeting in 2022, the assignments which were made at the meeting have not been revealed in full. Nikolai Patrushev referred to these assignments when he announced that Putin had taken the decision to create the Maritime Collegium of the Russian Federation, as a way of coordinating more effectively the work of the state authorities in implementing the national maritime policy and defending Russia’s national interests in the world’s oceans. This Collegium was created on 13 August 2024. At the same time, the Government Maritime Collegium was abolished. The latter had been set up in 2002 and chaired by Manturov, with Dmitry Patrushev as his deputy. Dmitry is a deputy chairman of the government and son of Nikolai Patrushev.

The Maritime Collegium of the Russian Federation has 52 members that include the Ministers of Industry and Trade, Transport, Agriculture, and Education and Science; the heads of regions with maritime coasts; the heads of the Border Service and the Chief Directorate of the General Staff of the Russian Armed Forces; and the directors of the largest shipbuilding companies. There are three councils within the Collegium: the Council for the Strategic Development of the Navy; the Council for the Defence of National Interests in the Arctic; and the Council for the Development and Security of Maritime Activity. Correspondingly, the Chairman of the Maritime Collegium, Nikolai Patrushev, has three deputies: Vakhrukov, Trutnev and Levitin.

Russia as ‘a great maritime power’

Putin came to power with the aim to ‘make Russia great again’. Initially, he counted on achieving economic growth and on increasing Russia’s share of the global economy, but this worked in reverse. Then he set his sights on becoming ‘an energy superpower’. The phrase and the idea appeared in 2006, when the price of oil rose (it reached $147 per barrel in 2007), and there was the ‘regionalisation’ of oil extraction. The same year Sibneft was sold to Gazprom, and in 2008 TNK-BP’s long-drawn out conflict began between BP and Alfa, the largest Russian shareholder. This ended only in 2013 with the sale of the whole company to Rosneft. Over time, the sharp drop in the price of oil finally put an end to the idea.

About the same time, almost at the end of Putin’s second term as president, the Kremlin began to play the ‘geostrategic greatness’ card. Putin’s speech to the Munich Security Conference in 2007 was seen by many as Putin signalling that he was ending good relations with the West.

Ports. With the collapse of the USSR, Russia lost most of its western maritime access (this is partly the reason for the seizure of Crimea and intentions expressed towards Ukrainian ports including Odesa and Mykolaiv). Not only were these important for the export of natural resources, but also a significant part of the USSR’s shipbuilding capacity remained in Ukraine. This led to the construction in the 2000s of major ports and terminals in Ust-Luga in the Baltic Sea; Vostochny in the Pacific Ocean; Taman in the Black Sea, and Sabetta in the Arctic. A combination of state and private capital financed this development.

Beginning in 2018, all the main seaports were forcibly brought under full state control.

- Novorossiysk (2018)

- Primorsk (2018)

- Baltiysk (2018)

- Murmansk (2022)

- Kaliningrad (2023)

- Vladivostok (2023)

- Terminals belonging to the ‘Delo’ group (2023: the NUTEP container terminal and then the KSK grain terminal in the port of Novorossiysk; the Petersburg Container Terminal and ‘Petrolesport’ in the port of St Petersburg; Vostochnaya (Eastern) Stevedoring Company in the post of Vostochny; ‘Moby Dick’ in Kronstadt; and the Ust-Luga Container Terminal in Ust-Luga)

- The KTsTL terminal in the Port of St Petersburg (2024).

Over the past 20 years Russia has increased its port capacity by more than four times: it was 337 million tonnes in 2003 and rose to 1,368.4 million tonnes in 2023. And it continues to grow. In fact, cargo passing through Russian ports over the past five years has taken up only two-thirds of the capacity. In 2023 transshipments through Russian ports amounted to 883 million tonnes, or 65% of the total capacity.

At first sight, it appears that Russia has over-invested in developing its ports. However, this disregards Russia’s strategic intention to increase its external trade, and the significant growth expected in the future in the transit of goods through Russian territory.

Early in 2022, Western sanctions significantly changed the dynamic of transport flows. External pressure meant that the turnover of cargo in ports in the North-West dropped, while the role of the ports in the Far East grew, to the extent that significant stress was put on the railway network in the east.

Vessels. Ports are not the only issue when it comes to solving the problem of outlets to the sea. A serious problem already – and one which is going to become even more strongly felt – is the shortage of vessels, especially large-tonnage vessels. Indeed, this threatens to become the major factor which will limit future ambitious plans, but it is already affecting Russia’s external economic relations.

After the meeting on the development of the shipbuilding industry in August 2022, which looked at the overall problems in the sector and specifically the position of the United Shipbuilding Corporation (USC), the leadership of the USC began to be changed. The chaebols led by Sechin (Rosneft) and Chemezov (Rostec) were engaged in a battle for USC, but neither of them was victorious. The Corporation was handed to Kostin. VTB was to hold USC in trust for five years. This was not the first time that Kostin had been given the role of temporary trustee and auditor of a major corporation.

Out of 760 sea-going vessels which were engaged in carrying Russian cargoes in 2021, 596 sailed under foreign flags and were not controlled by Russian ship owners. In 2022, these vessels left the Russian market. To make up for the loss of tonnage, more than 100 tankers were purchased, and 150 billion roubles was made available to buy a further 85 vessels, principally bulk carriers. But this did not satisfy the demand. In particular, 155 ice-strengthened vessels were needed to carry cargo along the Northern Sea Route.

At the end of March the Ministry for Industry and Trade approved the ‘List of critical industrial production in shipbuilding for 2024 and the 2025⁄26 planning period’. This laid out the need to construct 218 vessels over the next three years, including 14 tankers and 71 bulk carriers. But there are no facilities to construct so many vessels. There are 90 shipyards currently operating in Russia, but nearly all of these are designed for medium to low-tonnage construction.

Some years ago the Ministry for Industry and Trade reckoned on solving this ‘serious challenge’ through the ‘Zvezda’ shipyard in the Far East, as well as shipbuilding enterprises in St Petersburg and Kerch. But the yards in St Petersburg were overloaded with defence orders which continued to increase, as well as contracts for the high-technology, specialised fleet, notably icebreakers and commercial craft. Large tonnage shipbuilding in Crimea, in the yards in Kerch and Sevastopol, looks utopian today: Ukraine has shown on multiple occasions that it can strike Crimea with missiles and sea drones. In principle, a decision has been taken to construct a new large shipyard in St Petersburg or in the Far East, but no specific site for such projects has yet been found.

As for ‘Zvezda’, which has been in operation since 2016, Sechin complained to Putin back in 2019 that out of the 160 orders which the shipyard needed to become profit-making, there were only 36 in place, and most of these were orders from Rosneft. At that time the partners of ‘Zvezda’ were the Dutch firm, Damen; Daewoo, Hyundai and Samsung from South Korea; French firms Gaztransport and Technigaz; General Electric from the USA; and the Italo-Chinese company, Cosco Shipping. With the unleashing of the war in Ukraine and the imposition of Western sanctions the situation has become much worse. ‘Zvezda’ can forget about any sort of partnership or cooperation now. The only hope is Chinese partners; but they are lacking the technology, either their own or imported, which is needed to build ice-strengthened vessels.

In April 2023, the director of the department for the shipbuilding industry and maritime technology of the Ministry of Industry and Trade, Boris Kabakov, stated that it was essential to construct 985 vessels, 60 of them large tonnage vessels, by 2035. Some of them should be tankers and gas carriers which could transport hydrocarbons along the Northern Sea Route. The existing shipyards simply cannot handle such a volume of ships. So there is a serious shortage, not just of one, but of a number of large tonnage shipyards.

Logistics. Access routes and logistics companies are essential for a port to operate. The issue of access routes can be solved by expanding the Baikal-Amur Railway and the Trans-Siberian, which go to the Pacific Ocean. The issue of logistics companies can be sorted out in a similar way to that of the ports: by nationalisation or, to be more precise, re-nationalisation. The FESCO Transportation Group and its whole logistical structure was taken over by Rosatom, and the same fate befell the Delo Group, which included the country’s largest container transporter, ‘Transcontainer’. Also, eventually the state took back into its ownership the First Cargo Company, which was the largest railway operator in Russia.

In the current situation, when Russia is in a global stand-off with much of the world and the number of its vessels and ports is too small, other reliable logistics bases are needed as cargo handling centres. Quoting Andrei Belousov during his tenure as First Deputy Prime Minister, state media announced that, together with private business, the government was planning a major project with an initial cost of 131 billion roubles to create 12 trade and logistics centres on different continents.

In the first part of the plan, there are four hubs in Africa (in Egypt, Algiers, Tanzania and Senegal); one in Iran; one in India; and two in China. Where the others will be is unknown.

The high-ranking organisational and personnel changes (see above, part 1) have not so much started as consolidated and continued, on a new level, the strategic efforts to transform Russia into a great maritime power. These efforts have notably intensified, especially since the adoption in July 2022 of the Russian Federation Maritime Doctrine.

The story of an icebreaker

The story of the construction of the ‘Lider’ super-icebreaker gives an excellent insight not only into how decisions are taken and carried out in Putin’s Russia, but also specifically into the Kremlin’s plans for the Arctic.

Back in 2018, the construction of two of the biggest icebreakers in the world, known as Project 22220, seemed to be in full swing. In addition, there was Project 10510, the construction of the ‘Lider’ class icebreaker, which is twice as powerful. Yury Kovalchuk was behind the project, together with his unofficial wards, Sergei Kiriyenko and the senior management of Rosatom.

Contrary to economic logic and previously agreed plans, the order to build the first of three ‘Rossiya’ super-icebreakers of the 10510 series went not to the United Shipbuilding Corporation (USC) at its shipyard in the Baltic, which was where the 22220 icebreaker series was being built, but to the ‘Zvezda’ shipbuilding complex in the Far East. ‘Zvezda’ had recently become part of Sechin’s Rosneft chaebol. Putin ordered that the ‘Rossiya’ be launched in 2025.

When the state contract was signed with ‘Zvezda’ in April 2020, the maximum cost of the project was 127.6 billion roubles. However, ‘Zvezda’ not only did not have the experience of building such large and complicated vessels, it did not have the necessary production facilities either. With the aid of a Chinese corporation, the second stage of shipyard construction was immediately begun, involving the largest dry dock in Russia – something essential for building an icebreaker.

Once the dock was built, Rosneft decided that a new metallurgical plant would have to be constructed to provide the shipyard with steel plates. This contract would cost some 2.2 billion US dollars. The Ministry of Industry and Trade could see no sense in such a plant, and metals specialists spoke out against it on the grounds that the project was inefficient and superfluous. It was Sechin who pushed through the construction of the yard according to the Chinese plan, and Putin personally approved it. Construction should be completed by 2030. However, for the plant to be built, extra energy facilities must be constructed. And there is yet another problem: there are not enough highly qualified construction engineers for the unique icebreakers which are currently being built in the North-West, and at the same time to build icebreakers in the Far East. In peace time it may have been possible to attract specialists from Ukraine or South Korea to work on these projects. But there is no chance of that now.

During the war, the Russian army bombed the Energomashspetsstal’ plant in Kramatorsk in Ukraine, from where ‘Zvezda’ had ordered the ice teeth as well as rudder and propeller elements it needed for the project. It will take Russia two to three years to manufacture these parts itself.

There is yet another problem: a dependence on imported parts. In a nuclear icebreaker about 15–20% of the structure is imported. These are not ordinary parts, but unique mechanisms which would normally be ordered from the West and South Korea.

By December 2023, the icebreaker was only 11.14% ready. These construction delays will only get worse, and its launch can already be put back to the end of 2029. The ambitious plans to build three super-icebreakers have already been discarded, and in the latest edition of the Arctic strategy, from February 2023, only one ‘Lider’ icebreaker is planned. This will not be sufficient to keep the Northern Sea Route open all the year round.

The story of the ‘Rossiya’ super-icebreaker being built by ‘Zvezda’ – in other words, by Sechin’s company Rosneft – illustrates the extreme inefficiency of the system Putin has constructed. It relies on giant multi-faceted chaebol holdings which operate outside government control and answer directly to the president. This is not simply a question of corruption. The chaebols focus on the process and on financing from the budget, not on the end result. By achieving sovereignty in Putin’s understanding and making themselves independent of the other players in this game, the heads of the chaebols want to be self-sufficient and have total authority in their field. They are interested only in expanding their own monopoly.

The Northern Sea Route

By 2030, Russia should increase its shipping along international transport corridors by at least one and a half times compared to 2021, according to Putin’s order regarding national development targets.

The Northern Sea Route is the shipping passage through the Russian Arctic. It is described in official Russian documents as ‘historically the Russian Federation’s national transport route’. It goes along Russia’s northern coastline, through the seas which make up the Arctic Ocean: the Barents Sea, the Kara Sea, the Laptev Sea, the Eastern Siberian Sea, the Sea of Chukotsk and the Bering Straits. It links in a single transport route the European and the Far Eastern ports of the Russian Federation, taking in also the mouths of the navigable Siberian rivers. The route’s length from the Kara Strait to Providence Bay is 5,600 kilometres. But if one takes into account the greater Northern Sea Route, from Kaliningrad and St Petersburg to Vladivostok – an idea put forward in 2021 and now further developed by the government – then the length is extended to 15,000 kilometres.

The Northern Sea Route is much shorter than other maritime passages between Europe and the Far East. For example, going from St Petersburg to Vladivostok via the Suez Canal is a distance of 23,200 kilometres; by the Northern Sea Route it is 14,300 kilometres. According to Vladimir Panov, Rosatom’s special representative for the development of the Arctic, the passage should be navigable all the year round starting from 2024. Five years ago vessels could pass through the Northern Sea Route from July to November, but more recently the non-navigable period has been only from February to May.

The Kremlin’s hopes that the Northern Sea Route might become an alternative to the Suez Canal have not yet been realised, and not only because of the war. Even before Russia’s invasion of Ukraine, according to senior managers of companies which have now been nationalised, a major obstacle to the free passage of shipping through the passage was the FSB’s heightened interest in what was in the cargoes. The way in which the Northern Sea Route operates now is determined by Russia’s megaprojects in the Arctic.

In 2023, 36.2 million tonnes of cargo passed through the Northern Sea Route, which was 6.3% more than in 2022. In May of this year the Vice Premier, Yury Trutnev, announced that in 2024 nearly 72 million tonnes will be carried. The Arctic National Project foresees a major increase in these figures, from 53 to 150 million tonnes in 2030, and 220 million tonnes in 2035.

There is one important point to note. Of the 36 million tonnes which passed along the Northern Sea Route in 2023 only 2.1 million was in transit. The remainder were goods being delivered to the north of the country, both items without which the peoples of the north could not survive and other cargoes of necessary goods needed in the Arctic. To put this into context, last year the turnover of the port of Vladivostok alone was 32.2 million tonnes.

The Northern Latitudinal Passage is a railway corridor in the Arctic regions which can carry 23.9 million tonnes of goods in a year. To reach this figure, the infrastructure of the Northern and the Sverdlovsk railways would have to be developed, with a 700 kilometre connection built to link them up, from Salekhard to Nadym, with a bridge over the Ob River. Such a connection would cost 300 billion roubles (3.3 billion US dollars) to build.

The Northern Latitudinal Passage is a land route running parallel to the Northern Sea Route; it can be used all the year round. The idea behind it is that it links the Arctic regions by railway with the rest of the country and takes some of the strain off the Baikal-Amur Railway and the Trans-Siberian. It can also carry some of the loads from the Northern Sea Route. The main cargo on this route is gas condensate (50% of the carrying capacity), as well as oil and various by-products of oil. In addition, to stimulate environmental activities, it can pick up scrap iron that literally litters the arctic tundra, from barrels to broken equipment.

Over-the-top plans which haven’t been fulfilled

In 2023, the newspaper Kommersant published three possible scenarios for the development of the Northern Sea Route.

The Basic Scenario

The key prospective carriers – Rosneft’s ‘Vostok Oil’, and Novatek’s planned ‘Arctic LNG[Liquified Natural Gas]-2’, ‘Arctic LNG‑1’ and ‘Ob LNG’ – fulfil their plans and have no issues with a shortage of icebreakers or with infrastructure capacity. In this case, 74 million tonnes would be carried along the Northern Sea Route in 2024, rising to 224 million tonnes in 2030, and 230 million tonnes by 2035. Up to 75% of the cargo would be oil and LNG. ‘Vostok Oil’ has the greatest influence on these figures, as by 2024 it should already be transporting 30 million tonnes of oil a year, increasing to 100 million tonnes a year by 2030. This scenario suggests there will be 30 million tonnes of transit cargo on the Northern Sea Route by 2030.

In reality, ‘Vostok Oil’ has not even begun to transport oil in 2024. There is no oil terminal in the port of Bukhta Sever, from where it would send it, nor is there the infrastructure for the transportation of the oil; in effect, there is no resource base. In an article on 6 June 2024, the ever-obedient Kommersant described ‘Vostok Oil’ as ‘a potential project’.

Novatek’s ‘Arctic LNG’ projects are not in the best of condition: the first one is currently frozen; the production line for the second one has been installed, but it will not be put into action before 2027.

These were the comments of a Russian LNG market expert: ‘[After the introduction of sanctions] the first thing which became obvious was just how vulnerable the Russian LNG tanker fleet is. That’s why “Arctic LNG‑2” can’t even begin shipping. We have to create a new chain of deliveries and paid routes which don’t depend on Western countries. Only after these problems are overcome will it be possible to speak about the prospects for the next Russian LNG projects, like Murmansk LNG, Baltic LNG, Ob LNG or any others.’

The Optimistic Scenario

The volume transported along the Northern Sea Route will rise to 81 million tonnes by 2024; to 244 million tonnes by 2030; and up to 288 million tonnes by 2035. The extra growth will be thanks to Novatek’s future projects, ‘Arctic LNG‑1’ and ‘Arctic LNG‑3’. An extra 12.3 million tonnes of LNG is expected to be added from the ‘Yurkharovneftegaz’ mining project, as well as the project planned by Roman Trotsenko’s AEON Development company to open up the Syradasay deposit and the whole Taimyr coal basin. This scenario even takes into account Gazprom’s project which was cancelled long ago to produce LNG from the Shtokman field in the Barents Sea. The flow from this project is estimated to be around 17 million tonnes in 2028, and 50 million tonnes in 2035.

The Conservative Scenario

Novatek will cancel the ‘Ob LNG’ and ‘Arctic LNG’ projects because of sanctions. Other Arctic projects, including ‘Vostok Oil’, will be put on hold or their production will be cut back. Under this scenario, the flow will be 117 million tonnes in 2030, and 131 million tonnes in 2035; and transit transportation will reach 38 million tonnes per year. The transit flow along the Northern Sea Route will be seven million tonnes in 2024, thanks to redirecting coal production through the ‘Lavna’ terminal in Murmansk Region.

In fact, ‘Lavna’, via which they are proposing to redirect the flow of coal, is still being built.

Separately, Rosatom reckons that it can increase the transit along the Northern Sea Route by 2030 thanks to bilateral agreements with foreign partners about providing 50 million tonnes of cargo to China; ten million tonnes to South Korea; five million tonnes each to Japan, Vietnam and India; and three million tonnes to Thailand.

It is also planned that in 2024 there will be a group of icebreakers assisting transportation along the Northern Sea Route, consisting of eight nuclear and three non-nuclear icebreakers; and that by 2030 there will be nine nuclear and five non-nuclear icebreakers.

At this point, no one is even imagining that this number of icebreakers will be built.

The International North-South Transport Corridor

The agreement between Russia, Iran and India to create a multi-function transport route to connect India to Europe through Iran and Russia was signed back in 2000. At that time the 7,200 kilometre-long North-South Transport Corridor running from St Petersburg to Mumbai, was put forward as an alternative to the Suez Canal route and the Chinese ‘Belt and Road Initiative’.

Russia’s move in 2022 into a harsh confrontation with the West gave the project an added dimension, as a way of avoiding sanctions.

In the middle section, from Astrakhan to Tehran, the North-South Transport Corridor has three routes: the Western route, the Transcaspian one and the Eastern route. In 2022 the total flow of trade along these routes was 14.5 million tonnes. Of this, around 70% went via the Western route (10.3 million tonnes), about 25% (3.6 million tonnes) on the Transcaspian route, and some 5% (0.7 million tonnes) along the Eastern route. Approximately 75% (11 million tonnes) were Russian exports, and a quarter of the trade (3.5 million tonnes) were imports into Russian territory.

It is expected that the construction of a railway link between Iran and Azerbaijan will lead to a 13 to 20% drop in the transit of Russian exports through Turkey, including via the maritime route of the Bosphorus – Sea of Marmara – Dardanelles.

Both Russia and Iran actively use the corridor to send oil and oil products to India.

By 2030, Russia’s Ministry of Economic Development plans to increase the cargo turnover along the North-South Transport Corridor to 25 million tonnes. But the reality of the situation is still far behind this. Government forecasts in January 2023 estimated that by the end of that year the flow of goods along the corridor would increase by 80% of the figure for 2022, and reach 11.3 million tonnes. In fact, the total was only 7.8 million tonnes, an increase of a little over 24% on the previous year.

There are three Russian ports on the North-South Corridor, Olya and Astrakhan in the Volga Delta, and Makhachkala on the Caspian Sea. The total capacity of these three ports is 19 million tonnes. Active dredging operations in the waters of the Volga-Caspian Sea Shipping Canal, which would allow seagoing vessels to enter Olya and Astrakhan, were begun at the end of March and beginning of April 2022, immediately after the first wave of sanctions had been issued against Russia. Up until 2022 the Volga ports were working at only a third of their capacity, because of the shallowness of the channel.

As the Russian Vice-Premier, Marat Khusnullin, announced, the flow of goods along the corridor should double by 2025, to 30 million tonnes, and reach 35 million tonnes by 2035.

The North-South Transport Corridor and the Northern Sea Route both come under the remit of Igor Levitin, adviser to Putin, which is significant in Putin’s way of running things. The Chairman of the Committee on Economic Policy of the Federation Council, Andrei Kutepov, explained the task of both of these parts of the transport infrastructure as being to take the weight off the export supply chain in the east – that is, the Baikal-Amur Railway and the Trans-Siberian.

In reality, these eastern routes cannot cope with the problem of coal. There is a theoretical possibility to move coal from Kemerovo Region, where, as it happens, there is no transport capacity to move the 15–20 million tonnes of coal produced per year. This is exactly the maximum capacity of the North-South Transport Corridor. The coal could be moved westward via the South Urals, Volga and Northern Caucasus railway network to Astrakhan, or, even better, to Makhachkala, where there are small coal-handling capacities. However, this is pure speculation. Firstly, the possibilities of using such a route are slim; and secondly, the logistics would require a double transshipment of the coal, which would significantly raise the cost of transportation.

What seems more or less realistic is the redirection of a small portion of container shipments, which are considered secondary cargo compared to coal on the Eastern railway lines. Another utopian yet relatively sensible idea put forward by Deputy Minister Kabakov is to extend the North-South corridor to countries in Africa.

Is there a master plan?

In June 2024, Putin laid out clearly the logic behind the construction of a second new shipyard in the Far East:

‘It would be easier and cheaper to do this in the European part of our country. But when we take into consideration the long-term interests of the Russian state, we understand that it is essential to develop the Far East, and therefore to increase these capabilities there.’

It may seem odd during a war and at a time when Russia is under sanctions that, instead of taking the quicker and cheaper solution, Putin has gone for the more expensive option, in terms of both time and resources. What’s more, this is when the population of the country and the availability of the workforce are both falling. But then we can see that this is not simply the abstract development of the Far East, but preparation for a long-term confrontation with the West: not just for years, but for decades to come. When seen in these terms, both the Northern Sea Route and the accelerated reconstruction of the east can play a role as alternative routes for the swift manoeuvring of resources.

This is planning for ten years and more. The construction and exploitation of a major shipyard is a long-term project. In the thinking of the Ministry for Industry and Trade that is at least seven or eight years. But considering the shortages in the Far East of labour, energy and metals, this will clearly take even longer. Building large tonnage vessels also takes many years. This means that ships which are built in the new shipyard will not be launched before the mid or even late 2030s. That is the perspective which the Kremlin was looking at when this decision was taken.

Looking back three, ten or even 25 years, it is easy to think that the roots of these ambitious geostrategic projects, and what is going on now, are all part of one massive plan.Yet this is not the case. This looks more like geostrategic manoeuvring. Putin’s regime was presented with ever more financial opportunities, and in each case the choice made was always the one which would strengthen the Kremlin’s position in its confrontation with the West.

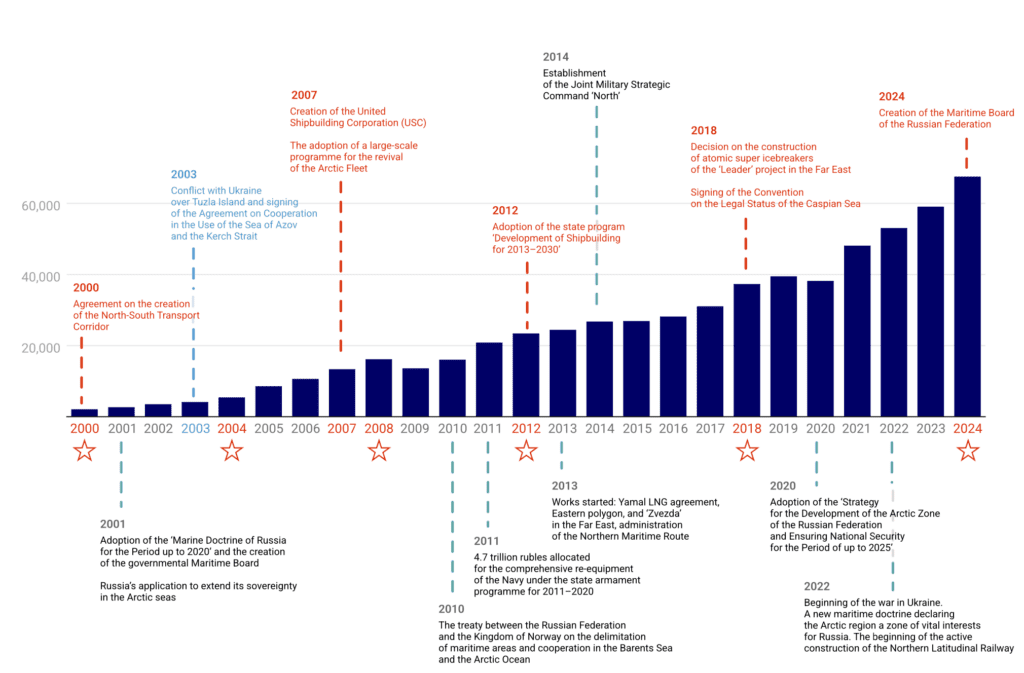

Part of the key geostrategic decisions and achievements are shown in figure 1. The modest chronology it displays does not reflect the joined-up nature of the process, such as the construction of new maritime ports and the development of the infrastructure of the existing ports, which was going on all this time; the creation of the monopolies, which began in 2007; and the nationalisation of the ports and their infrastructure, which started in 2018 and has been particularly strong in 2023 and 2024. There were other developments, too.

It is worth paying attention to the way in which this movement has been carried out. These geostrategic plans and the first steps in this direction appeared right at the start of Putin’s time in power, when he became president in 2000, and took off properly towards the end of his second term in 2007, with the growth of the Russian budget and the possibilities this brought.

To some extent this process is cyclical. This is shown especially by the creation within the government in 2000 of the Maritime Collegium‑1, and then the Maritime Collegium‑2 – now directly under the president – in 2024, a quarter of a century later. In between these two dates there have been quasi-presidential cycles, with notably more intense activity at the start of each: 2007, 2013, 2018 and 2024.

Finally, there have also been backward steps; plans and projects that have run into the ground, or have had to be abandoned for various reasons. (For example, the development of the Shtokman field; the creation of the ‘North’ strategic command centre; ultra-high speed railway lines; and the Northern Latitudinal Passage.)

This is less a question of attempts to realise a grand plan so much as an indication of a movement in one particular direction; a movement that not only creates a reserve for the future, but brings very specific, serious results. Parts of this are the massive ‘Yamal LNG’ project with the port of Sabetta; the ‘Zvezda’ shipbuilding complex; two almost completed stages of the Eastern territory project, which has seen the carrying capacity of the Baikal-Amur Railway and the Trans-Siberian increased from 75 million tonnes per annum to 180 million tonnes; and the Russian part of the North-South Transport Corridor. There have been other achievements, too.

It goes without saying that these geostrategic megaprojects strengthen Russia not only economically, but militarily, too. Every part of them – the infrastructure, the production capability and the technology – has a dual purpose.

Underpinning the huge resources which have gone into the realisation of these geostrategic projects there is not simply a sober calculation by the Russian elite, but a vision, too; in fact, at least two visions.

Pragmatic: The idea is to develop the Russian frontier lands to the north and the east, creating a specific role for the Arctic in the world of the future, in connection with global warming and a shortage of resources – in its way, a kind of colonial division of unclaimed territories (this would explain Russia’s application to the UN to recognise that a huge part of the continental shelf belongs to Russia). This is a radical restructuring of the Russian house, turning the back door into the façade, which will now face the world.

Geopolitical: This reflects the ideas of Carl Schmitt – sea versus land – or, in the words of Russian philosopher Alexander Dugin, tellurocracy versus thalassocracy. Russia should maintain its advantage as a ‘civilisation of the land’ and use this to maximum effect, yet at the same time exploit its advantage as a ‘maritime civilisation’. With its military and civilian purpose, the Northern Sea Route helps to build Russia’s world-view balcony replacing Peter the Great’s ‘window on Europe’, while at the same time providing defence for the Heartland.

Numbers: revenues of the consolidated budget of Russia in 2000–2024 (in billion rubles). ☆ Russian presidential elections

Military considerations

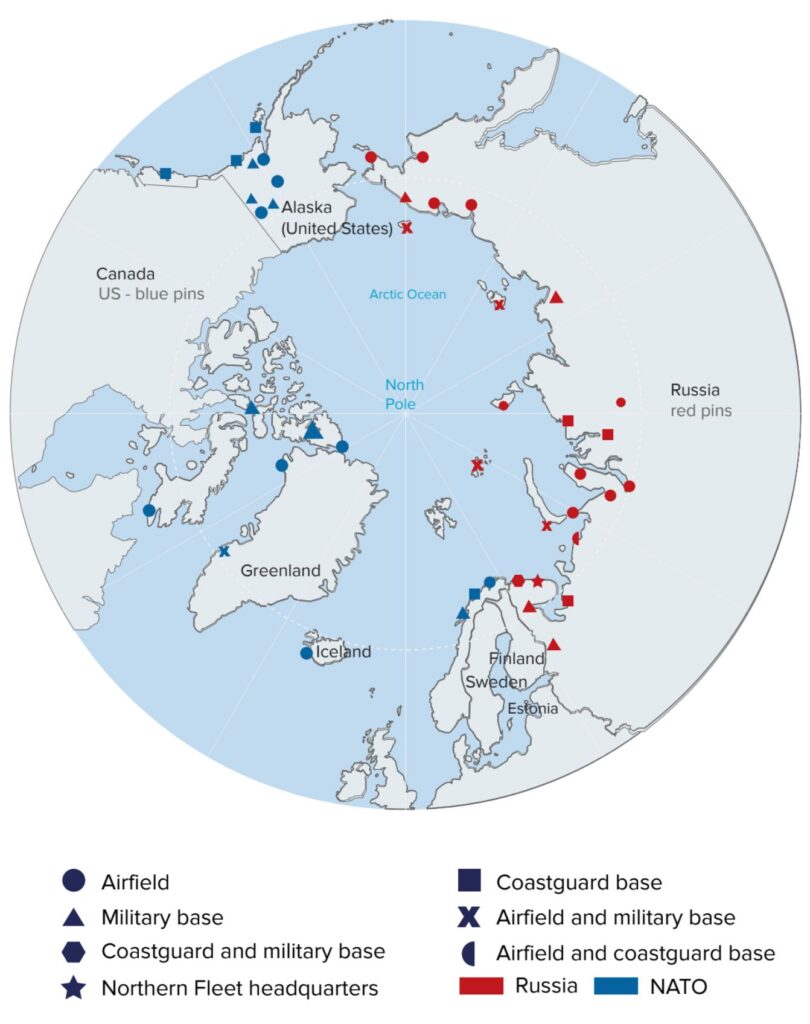

In view of the current extreme levels of tension in relations with the West arising from the war on Ukraine, the Russian leadership believes that the Arctic has taken on even greater strategic significance for Russia. It also sees the region as one of global competition because of its rich mineral resources and the Northern Sea Route.

The Kola peninsula remains central to the defence of Russia’s north, delivery of its nuclear deterrent and the foundation for power projection into the Arctic and Atlantic. Its bases accommodate land, air and naval assets, including nuclear weapons. It is also home to the headquarters of the Northern Fleet whose tasks include protecting the Northern Sea Route and supporting exploration activities in the Arctic. The Pacific Fleet also has a role in defending the region.

The Russian leadership sees the Northern Sea Route as providing access to the countries of South-East Asia, India, the Gulf and Africa, markets that have become more important for Russia’s trade because of Western sanctions, perceived Western efforts to prevent Russia’s access to the sea, and the perceived unreliability of other routes. The 2022 Maritime Doctrine states that one of Russia’s priorities in the Arctic is ‘enforcing control over the activities of foreign navies in the waters of the Northern Sea Route.’

Since 2005, Russia has invested heavily in port infrastructure and vessels to defend the Northern Sea Route, revitalising old naval, air and land bases in the Arctic and building new ones. These now outnumber NATO’s by around a third. To provide greater security of the Northern Sea Route will require substantial further expansion and upgrading of the military bases. These are far apart with limited connections between them and they are difficult to support logistically.

In 2020, Putin upgraded the Northern Fleet to a military district in recognition of the increased importance of the Arctic region in defence planning. This was the first time that a fleet had ever been elevated to this status. It marked the culmination of a significant military buildup that saw the resumption of long-range Russian bomber patrols in the region and plans to equip the Northern Fleet with the ‘Kinzhal’ hypersonic missile that was demonstrated in 2021. The Northern Fleet had also invested in new air-defence capabilities to defend the Arctic, including the introduction of the advanced S‑400 missile system as well as broader deployment of S‑300s.

These and other deployments attracted US attention but little by way of response. US defence planners have shown limited interest in the Arctic because, unlike Russia, the US does not perceive the need to control the region to exercise its nuclear weapons delivered from land, sea and air. At the same time, the Russian Navy effectively does not try to compete with US naval power in the Atlantic.

This situation may change if Chinese interest in the Northern Sea Route increases. In June, Rosatom announced a partnership with China’s Hainan Yangpu New Shipping to design and build container ships and jointly operate a year-round shipping line along the Northern Sea Route. For now, fear of western sanctions is restricting Chinese investment in developing the route.

Strikingly, the Northern Fleet quickly lost its new-found status after Finland and Sweden joined NATO. In February 2024, Putin signed a decree re-incorporating the Fleet into the re-established Leningrad Military District, a reflection of the changed geo-strategic environment, including a new 1,340 km land border between Russia and NATO where Russia plans to station a new missile brigade.

Visiting Murmansk in August, Patrushev complained that the US and its allies were increasing their presence in the Arctic and that the NATO membership of Finland and Sweden ‘worsened the situation’. He said that increasing the combat readiness of the Northern Fleet was one of the priorities for ensuring Russia’s national interests in the region.

While the Arctic has taken on increased civil and military importance for Russia and is likely to attract significant further investment, there is no sign for now that this will become a serious source of tension with the US and its allies. If Russia is serious about developing the Northern Sea Route and deploying naval power in support of economic goals, it will need to strike a balance between its legitimate interest in protecting the Route and not provoking countermeasures by others that could deter trade.

In any event, the Arctic remains extremely challenging to ship navigation due to ice, weather, poor charting, and limited search and rescue and other infrastructure.

Communication between Arctic states will be a priority for confidence-building and managing disagreements related to military activity in the region. No dedicated forum exists for this purpose. Dialogue and cooperation with Russia in the Arctic Council has been suspended since the start of the war on Ukraine. Since its formation in 1996, the Council is widely seen to have been a useful mechanism for forging common approaches in the region, but it has deliberately stayed clear of military issues. Other dynamics within this group of countries have also changed since Russia is now the only member outside NATO after Finland and Sweden’s accession to the Alliance. While Russia has not yet voted to leave the Council, this possibility cannot be excluded if relations with NATO countries deteriorate further.

Conclusions

Tactically, Putin’s major projects are a way of circumventing Western sanctions; strategically, they represent an alternative type of globalisation, and a new model for Eurasian security.

As is often the case with geostrategic projects, they look fine on small-scale maps; but closer examination reveals critically important problems and bottlenecks which will make it impossible to fulfil them in the planned time-frame.

The bad news: The Kremlin’s ambitious geostrategic transport projects are advancing slowly, but they are coming to fruition, and in the long run they will ease the effects of Western sanctions.

The good news: These projects are taking up massive resources which therefore are not being used for the war; and after a change of regime they could play a positive role for Russia and the world.

Putin’s chaebols lie at the foundation of the management of the Kremlin’s mega projects, notably Rosatom, Rostec, VTB Bank with the United Shipping Corporation, and Rosneft. All bets are on them and on the competition between them, and nationalisation in the relevant sectors of the economy is being stepped up to assist them. Within the Presidential Administration a powerful headquarters has been established under Nikolai Patrushev to ensure that operationally the leader of the plan is the president, not the government or governmental structures.

From the first days and months after the unleashing of the full-scale war on Ukraine and the imposition of the first packet of sanctions, the decision-making process has undergone serious changes. It has switched from the rapid, demonstratively optimistic position of Putin stating what he wants, to a more considered and realistic position of achieving what is possible. On the one hand, this shows the serious difficulties which the authorities have come up against when trying to implement these significant projects while under sanctions; and on the other hand the great capabilities of the authorities and of Putin personally.

The Kremlin’s geostrategic megaprojects have a dual nature:

- A new mythology that gives Putin’s elites, including Putin himself, an image of the future in defiance of the ‘evil West’;

- A realistic project for investment and administration along the lines of Lenin’s early plan to electrify the whole country [Lenin famously declared, ‘Communism is Soviet power plus the electrification of the whole country’]; intuitively, this has already been in operation for a long time, and now it has become more clearly defined and accelerated.

Both aspects demonstrate that, in the third year of the war and the harsh confrontation with the West, the mood among Putin’s elite is not flagging but is aggressive and on the offensive.

Despite relative financial abundance, resources and opportunities which are sufficient to carry out these megaprojects fully, Putin’s regime must implement radical change. The discrepancy between reality and illusions, formalised in plans, will sooner or later lead to ‘withdrawal’. This is already illustrated by the collapse of the timeframe for building ships, which led to the audit of the United Shipbuilding Corporation and its transfer to VTB; problems with the construction of super icebreakers and the creation of a satellite grouping in the Arctic (the drawing back of the Arctic strategy); and the failure to implement the planned aircraft manufacturing programme (leading to the audit of the United Aircraft Corporation).

At the same time, the project, based as it is on a lengthy confrontation with the West, may outlast the regime and become an undertaking of a different nature for the next generation of the Russian elite.