Russia’s wartime growth engine is losing steam. According to Rosstat’s preliminary estimate, GDP in Q1 2025 declined unexpectedly compared to Q3 2024. This outcome reflects two main factors:

- First, defence-related industries are already operating near full capacity.

- Second, activity in the civilian sector remains constrained by high interest rates.

The Kremlin refers to this slowdown as an ‘intentional soft landing’. In reality, the economy is burdened by structural imbalances, most visibly expressed in persistently high inflation.

The limits of war-industrial expansion

Russia’s war economy has reached its operational ceiling. Since late 2022, defence-related industries have shown sustained growth, with specific segments expanding by 300–500 per cent compared to 2021. However, as enterprises approach the limits of their industrial capacity, this growth is losing momentum and can no longer drive the broader economy. Meanwhile, contraction in non-military sectors – driven by collapsing demand, prohibitively high borrowing costs, and acute labour shortages – is increasingly visible. The sharpest declines were recorded in the production of excavators (down by 48.6 per cent) and titanium products (down by 45 per cent), reflecting a steep drop in investment and the continuing impact of Western sanctions.

A perfect storm hit agriculture: a high, though not record-high, grain harvest depressed domestic prices, while the sharp appreciation of the rouble made exports unattractive. This combination of low margins and weak demand for credit at interest rates above 20 percent led to a collapse by one-third in agricultural machinery sales and a drop in production of over 20 percent in the first quarter. In mid-2024, the government significantly cut mortgage subsidies, which led to a decrease in residential construction and production of construction materials.

The restructuring of Russia’s foreign trade was completed in 2024. China’s share in Russian imports stabilized at around 40 per cent, up from approximately 25 per cent in the pre-war period, while the share of the European Union and the United States fell from 60 to 30 per cent. At the same time, the Kremlin’s pressure to switch to national currencies in mutual trade has led the Chinese authorities to restrict exports to Russia based on the volume of Russian commodities exports.

The Russian economy’s technological dependence on China continues to grow. The Russian machine tools supply is now dominated by Chinese imports, filling the gap left by the collapse of deliveries from Japan, Germany, and South Korea. This shift reflects a broader effort to maintain production capacity, particularly in defence. Electronics manufacturers remain especially exposed, as their assembly lines continue to rely almost entirely on foreign machine tools. In 2024, an estimated 98.3 per cent of all machine tools purchased by Russian firms were imported. Although total purchases fell from a 2023 peak of 1 million units to 693,000 in 2024, imports from China surged, accounting for 71 per cent of total value ($1.61 billion), up from just 20–25 per cent in 2020–2021. In volume terms, around 35,000 of the 45,800 imported machines – roughly 75 per cent – originated from China.

Despite the Kremlin’s hopes, there is little evidence of large-scale mobilisation of civilian industry for military needs. In fact, there are documented cases of enterprises refusing to comply with mobilisation plans due to economic infeasibility. Meanwhile, discontent has emerged inside the state corporation Rostec, where the halt in arms exports and the loss of markets have caused internal friction.

Inflationary threat and business gloom

The greatest risk to the Russian economy is accelerating inflation, likely triggered by a weakening rouble. Inflation is a symptom and a signal of deepening economic imbalances, driven by the prolonged redirection of financial resources toward the war effort.

Although the rouble appreciated by more than 30 per cent between November 2024 and May 2025, it remains unstable, driven by speculative carry-trade inflows. In fact, rouble devaluation appears imminent, driven by three factors: seasonal demand for foreign currency at the end of summer, the Finance Ministry’s interest in boosting budget revenues (over 35 per cent of which are tied to the rouble-dollar exchange rate), and expectations of monetary easing by the Central Bank of Russia that could reverse carry-trade inflows.

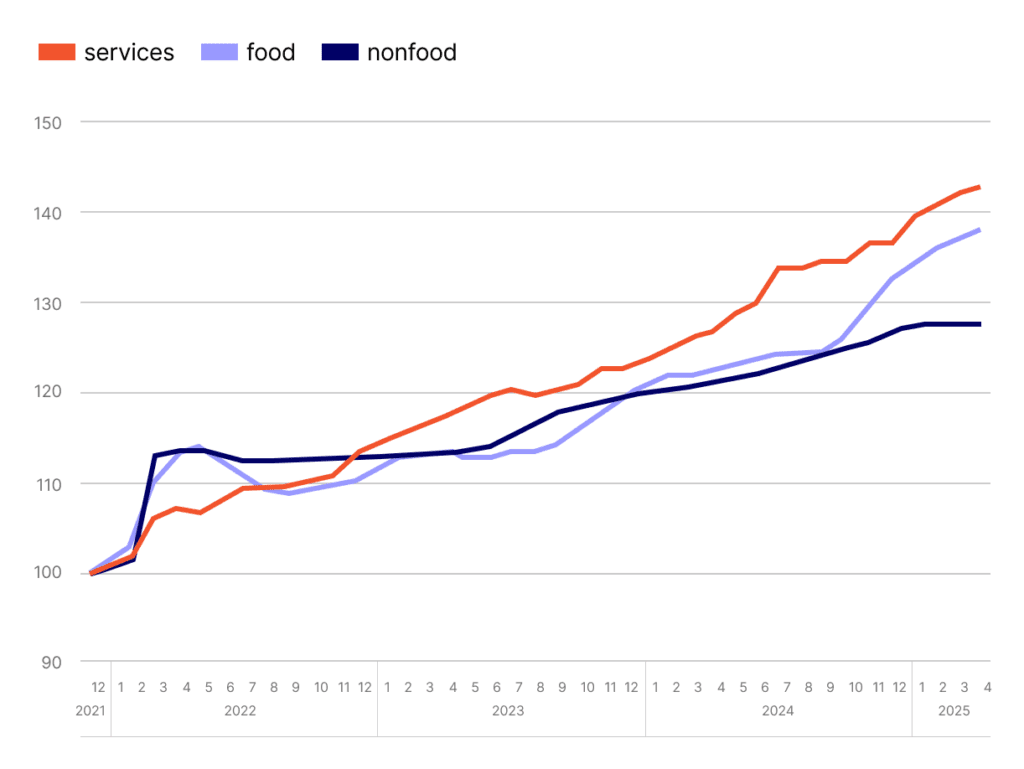

The strong rouble allows the Central Bank to present its policy as a success, with inflation showing a slight slowdown in recent weeks. However, the evidence is mixed. Food and service prices continue to rise faster than a year ago, while the overall deceleration in inflation is entirely due to non-food prices, which have grown much more slowly in 2025 compared to the previous year. Still, given that over 40 per cent of Russia’s non-food retail consists of imported goods, this ‘deflation bonanza’ is likely to be short-lived – potentially an unwelcome surprise for both the Kremlin and the Central Bank.

Russian Consumer Inflation by Components, 2022–2025

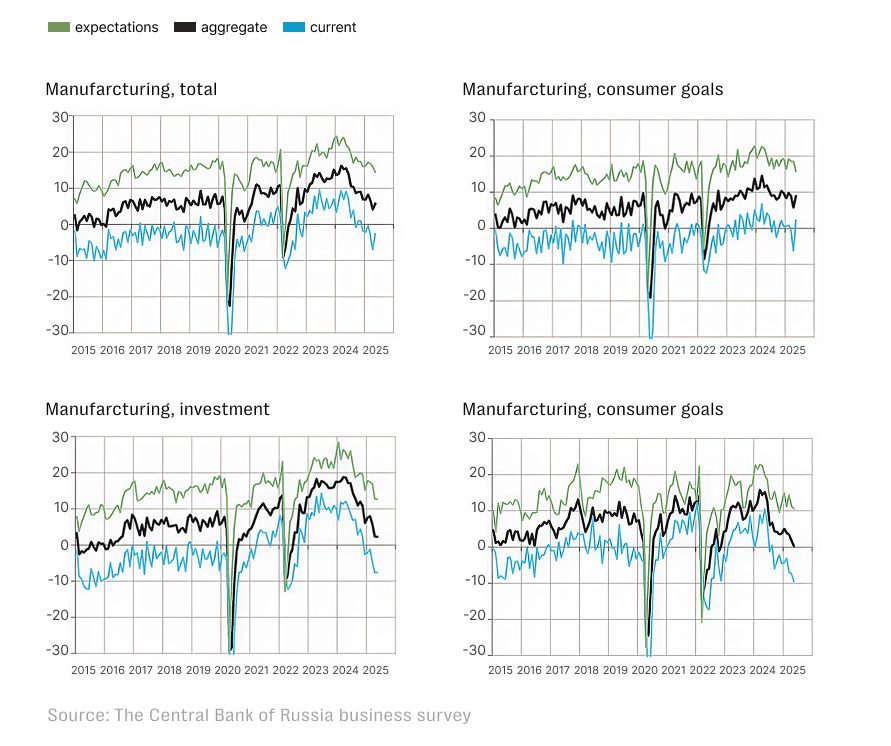

This overall imbalance is weighing on real-sector dynamics. Business sentiment surveys reflect mounting concern among enterprises. The Central Bank’s latest data show a sharp decline in confidence across most major sectors, with manufacturing, construction, trade, and logistics reporting quarter-on-quarter drops of 6 to 12 points. Only agriculture, buoyed by favourable weather expectations, and the service sector, which are less sensitive to interest rate shocks, show relative optimism. Overall, the outlook remains bleak. Inflation is not an abstract metric but a tangible operational constraint for businesses grappling with weak consumer demand, narrowing margins, and costly credit.

Russian business sentiment across industries

The Russian economy remains reliant on raw material exports. While this does not make it efficient, it does make it stable. It has adapted to Western sanctions, and there is little evidence that additional sanctions would exert significantly greater pressure.

There is no indication that Russia’s military-industrial complex can continue driving overall economic growth. However, it also faces no immediate constraints that would lead to declining production of weapons, military equipment, or munitions.

Although falling oil and gas revenues have forced the Ministry of Finance to revise its budget forecast and expand the deficit, this does not undermine its capacity to finance Putin’s war. In any case, the ministry retains ‘spare capacity’ to increase spending: through potential rouble devaluation (which would boost revenue), expanded domestic borrowing supported by the Central Bank, and – within limits – using fiscal reserves, specifically from the National Welfare Fund.